Saudi Arabia Poised to Price Light Crude at a Discount for First Time Since 2020

Aramco may set Arab Light oil below regional benchmarks amid ample global supply and weak demand

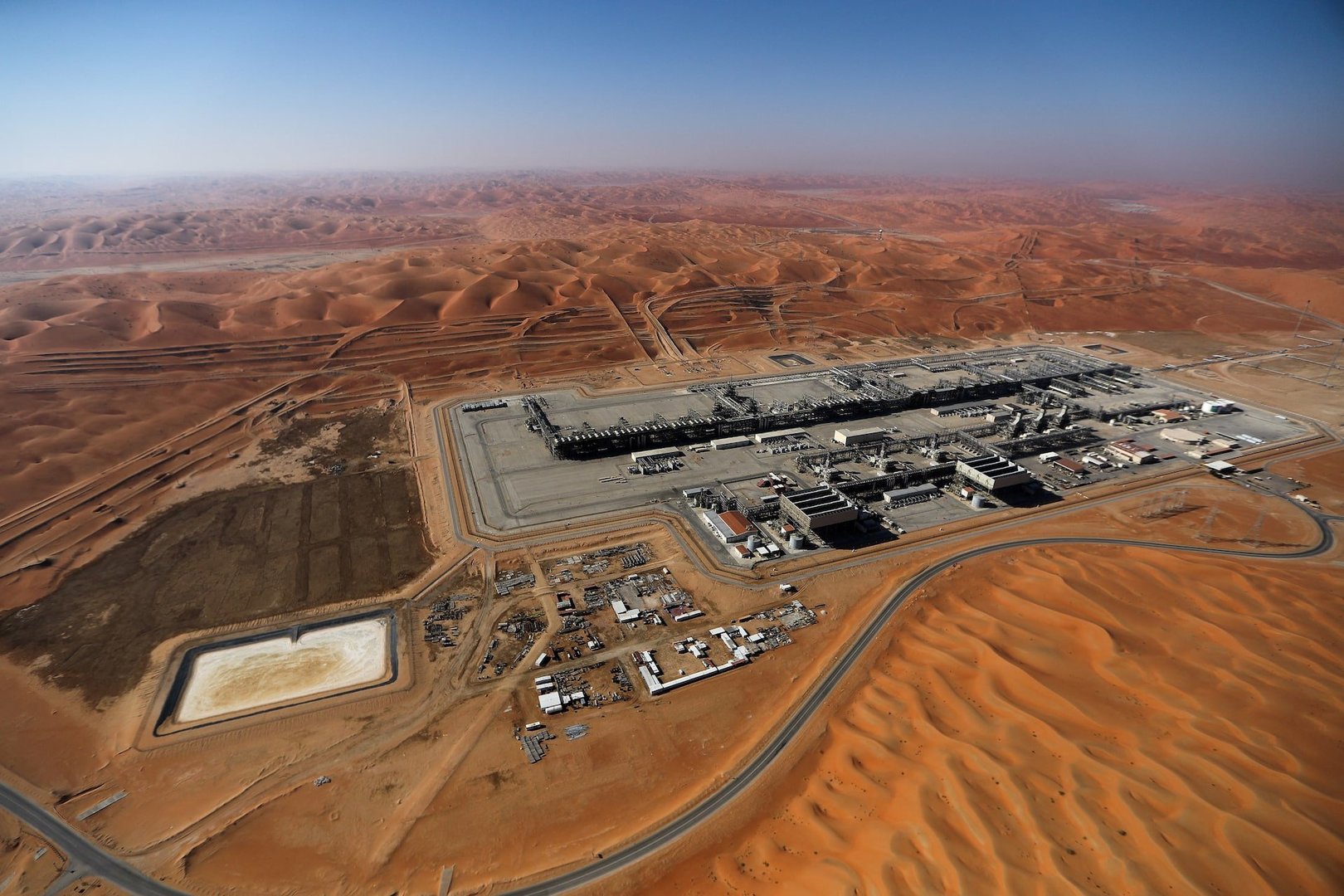

Saudi Arabia is considering setting the official selling price of its flagship Arab Light crude at a discount to Middle Eastern benchmarks for the first time since 2020, underlining shifting dynamics in the global oil market.

Trading sources have indicated that the price of Arab Light for delivery to Asia may be reduced further for March shipments, potentially placing it between twenty cents and fifty-five cents per barrel below the Oman/Dubai benchmark if the cut goes ahead.

This would mark a rare departure from recent pricing patterns, in which Saudi crude typically sold at a premium to regional benchmarks even during periods of falling prices.

The possible discount reflects mounting oversupply concerns and subdued refinery demand in key markets, particularly in Asia, where refiners have been reluctant to commit at higher price levels.

The prospective discount follows a series of price cuts by Saudi Aramco for Arab Light crude to Asia, with recent official selling prices already at historic lows relative to benchmarks.

For February deliveries, the price was set at just thirty cents above the Oman/Dubai average, the lowest premium in more than five years, after successive monthly reductions.

Analysts suggest these adjustments aim to preserve Saudi market share at a time when global crude supplies exceed demand growth and spot Middle Eastern benchmarks have softened.

The trend has also coincided with decisions by the Organization of the Petroleum Exporting Countries and its allies to pause plans for output increases in early 2026, underlining producers’ cautious approach to balancing markets.

A discount on Arab Light would be noteworthy because Saudi pricing typically sets the tone for other Gulf producers, influencing around nine million barrels per day of crude exports.

The last time Saudi light crude traded below benchmark levels was during the tumultuous 2020 price war, when Russia and Saudi Arabia briefly flooded markets at deeply discounted rates.

Modern oil markets have since evolved, but the potential pricing shift highlights persistent uncertainties in demand recovery and the competitive pressures facing traditional crude exporters.

Traders will watch Aramco’s official announcement, expected in early February, for clarity on how far and how quickly pricing will adjust as the oil industry navigates the evolving supply-demand balance.

Trading sources have indicated that the price of Arab Light for delivery to Asia may be reduced further for March shipments, potentially placing it between twenty cents and fifty-five cents per barrel below the Oman/Dubai benchmark if the cut goes ahead.

This would mark a rare departure from recent pricing patterns, in which Saudi crude typically sold at a premium to regional benchmarks even during periods of falling prices.

The possible discount reflects mounting oversupply concerns and subdued refinery demand in key markets, particularly in Asia, where refiners have been reluctant to commit at higher price levels.

The prospective discount follows a series of price cuts by Saudi Aramco for Arab Light crude to Asia, with recent official selling prices already at historic lows relative to benchmarks.

For February deliveries, the price was set at just thirty cents above the Oman/Dubai average, the lowest premium in more than five years, after successive monthly reductions.

Analysts suggest these adjustments aim to preserve Saudi market share at a time when global crude supplies exceed demand growth and spot Middle Eastern benchmarks have softened.

The trend has also coincided with decisions by the Organization of the Petroleum Exporting Countries and its allies to pause plans for output increases in early 2026, underlining producers’ cautious approach to balancing markets.

A discount on Arab Light would be noteworthy because Saudi pricing typically sets the tone for other Gulf producers, influencing around nine million barrels per day of crude exports.

The last time Saudi light crude traded below benchmark levels was during the tumultuous 2020 price war, when Russia and Saudi Arabia briefly flooded markets at deeply discounted rates.

Modern oil markets have since evolved, but the potential pricing shift highlights persistent uncertainties in demand recovery and the competitive pressures facing traditional crude exporters.

Traders will watch Aramco’s official announcement, expected in early February, for clarity on how far and how quickly pricing will adjust as the oil industry navigates the evolving supply-demand balance.