Why property prices are falling faster in the UAE than the rest of the world

Residential prices in Dubai and Abu Dhabi have fallen the most compared to 150 cities around the world, new research reveals.

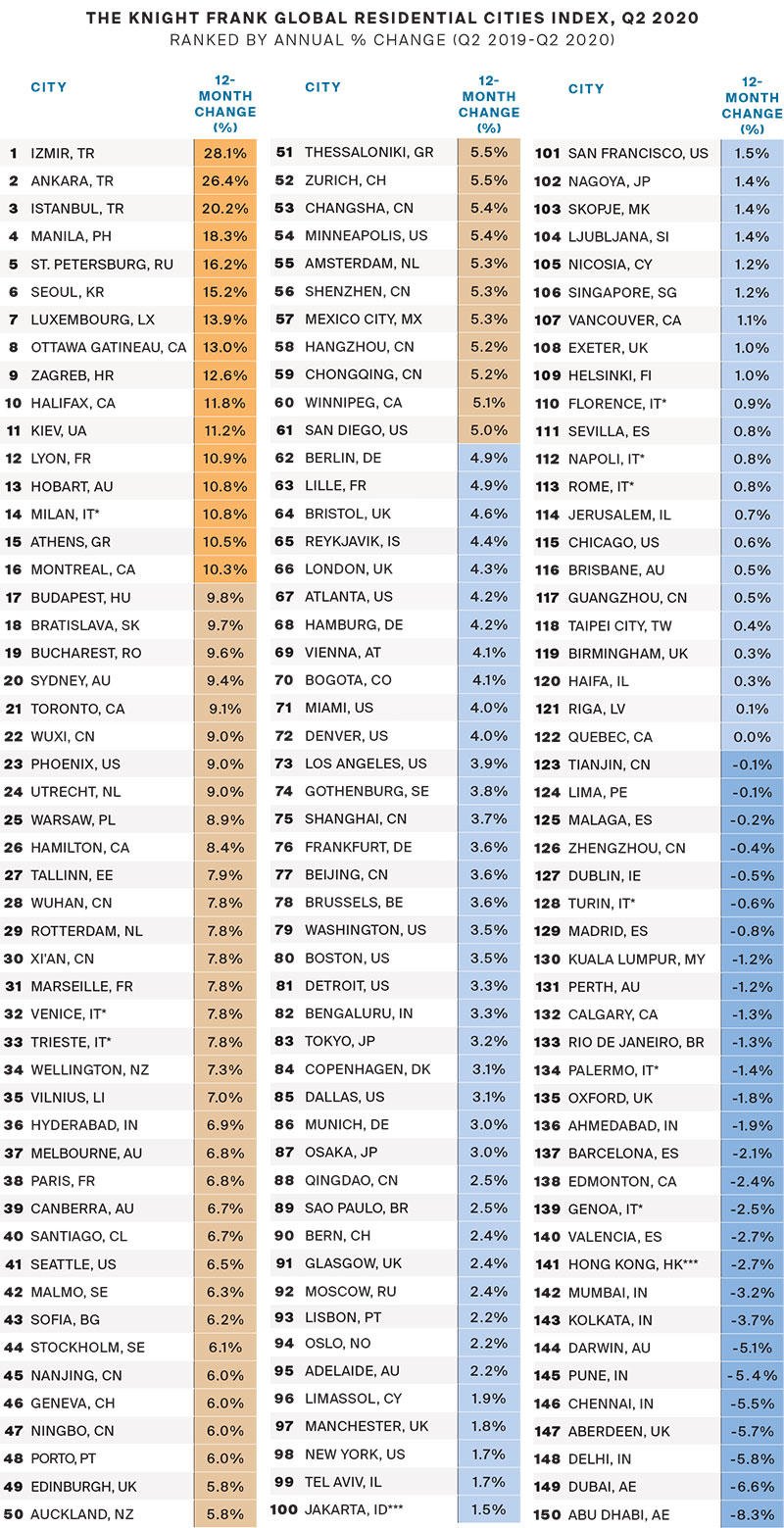

According to the latest Knight Frank Global Residential Cities Index for the second quarter of 2020, Abu Dhabi values fell by 8.3 percent and Dubai by 6.6 percent over the past 12 months.

This compared to the average annual price growth of 3.4 percent across the 150 cities analysed.

Taimur Khan, associate partner at Knight Frank Middle East, told Arabian Business: "Over recent years the UAE’s property market has transitioned through a range of different stages. This trend has been underpinned by the speed of growth and expansion in its built environment, which has brought about challenges where property market cycles in Abu Dhabi and Dubai have certainly been more volatile in comparison to more established cities.

"Additionally, over this time period a combination of lower oil prices, global and local economic uncertainty, the stronger US dollar (which has fed through to the dollar-pegged dirham), the introduction of stringent mortgage regulations and high levels of new supply have helped provide a correction to the market."

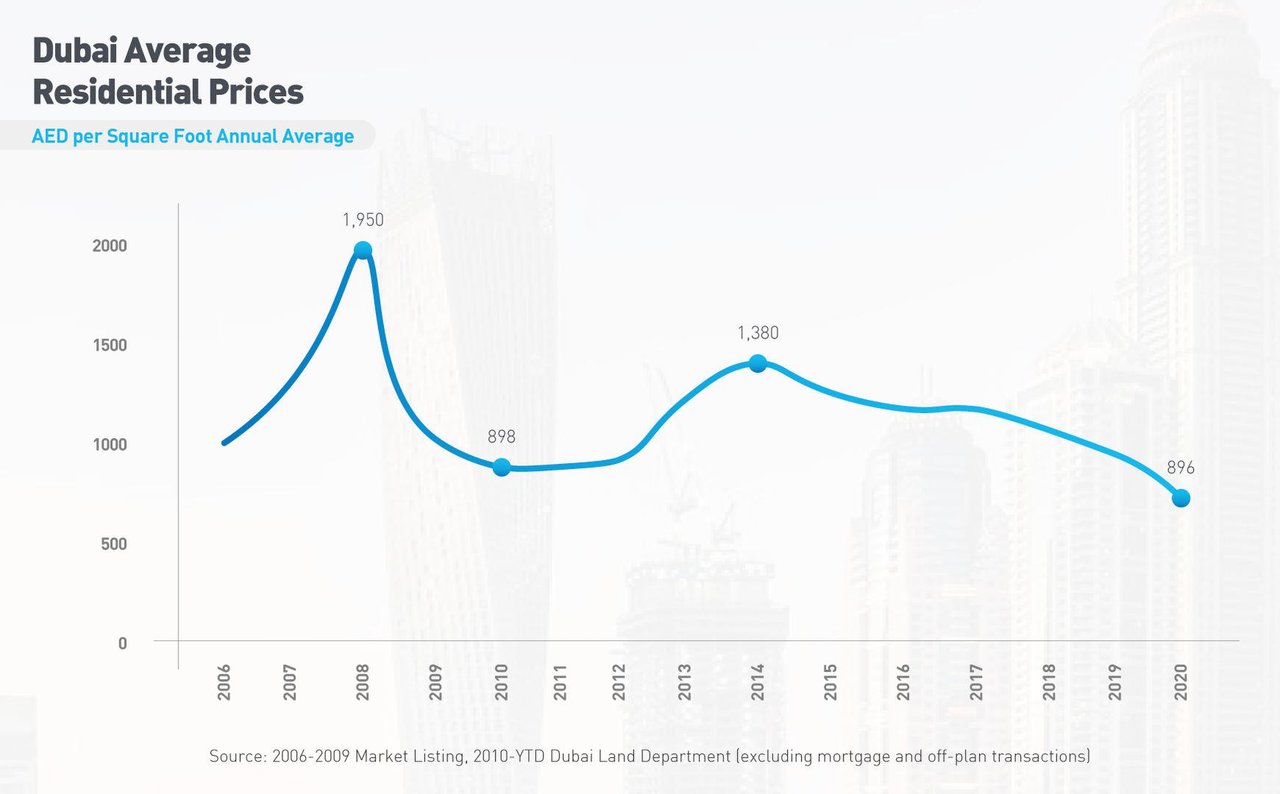

He added: "The latter has been particularly true for Dubai, where as a result, average residential prices in Dubai are not far from the last decade’s historic lows. However, it is important to remember that Dubai is a collection of micro-markets so the headline numbers do not always tell the full story, which is that we are seeing the early stages of a recovery ensue.

"Secondary areas and areas with an influx of supply are certainly still seeing considerable price declines, however, certain prime areas such as the Palm Jumeirah, Jumeirah Bay and District One have seen their respective average price per square foot increase in the first eight months of this year by up to 6 percent compared to the same period a year earlier."

Khan described the Abu Dhabi market as "comparatively more nascent", adding that new supply is relatively measured and as a result, any upturn in the market is likely to be closely linked to the economic backdrop of the emirate.

He added: "Whilst there are clear challenges facing the residential market in the UAE, historically from a supply perspective and now more so from a demand perspective, authorities and developers have enacted a range of legislations and favourable payment options respectively to support demand."

As part of the UAE Central Bank’s economic stimulus package, loan-to-value ratios have been increased for first time buyers by five percent for all property purchases, including off-plan property mortgages.

This change was in addition to a range of regulatory changes announced in 2019, which included the announcement of 100 percent on-shore business ownership, easing of visa regulations, the introduction of the golden visa residency scheme and Abu Dhabi’s freehold ownership law.

"As many of these regulatory changes, such as the changes in visa regulations, are linked directly to property ownership, the long-term fundamentals underpinning demand for UAE real estate remains steadfast. Such substantial and swift changes have already spurred the market, even during this volatile period, and may also help provide support to price levels going forward," Khane added.

His comments follow a recent report by UBS which said Dubai's real estate market remains fairly priced compared to other major cities in the world after seeing six years of falling values after reaching a peak in 2014.

The UBS Global Real Estate Bubble Index 2020, a yearly study by UBS Global Wealth Management's Chief Investment Office, indicated that the Dubai property market is likely to see a rebound in the mid- to longer-term and "remains a very attractive hub for financial services and many other industries".

The Knight Frank data showed that Izmir in Turkey is the city with the highest rate of annual growth in the year to June, rising 28 percent with a further 16 cities registering double-digit price increases in the same period.

It added that 19 percent of cities registered an annual average price decline.

Earlier this month, real estate consultancy ValuStrat said property prices in some parts of Dubai reached new decade-long lows in September.

The annual average price per sq ft fell to AED896 for 2020, AED2 lower than the previous low seen in 2010 following the global economic crisis.

The figures were published by real estate consultants ValuStrat in its monthly report on the Dubai property market.

The real estate sector was already battling sluggish market conditions long before Covid-19 arrived. But the pandemic, in combination with the postponement of Expo 2020, has added further uncertainty, characterised by projects being delayed, and both values and rental yields reflecting the unfavourable climate.

There is also material uncertainty in the sector’s investment market performance, and experts believe this scenario is likely to remain well into 2021.