The lessons that can be learned as Vice joins digital media casualty list

The tech sector is used to seeing companies lurch from boom to bust in a very short space of time.

Seldom, though, has there been as dramatic an evaporation of value as the one experienced at the digital media start-up Vice.

From a peak valuation of $5.7bn, in 2017, it looks set to be picked up for just $225m after filing for Chapter 11 bankruptcy protection.

It is quite the comedown for a business founded in 1994 in Montreal as a punk magazine and which, at the height of its popularity, employed 3,000 people around the world while owning an ad agency, a film studio, a cable network and a record label.

It even bought a pub, the Old Blue Last in Shoreditch in east London, where the likes of Amy Winehouse and Arctic Monkeys played secret gigs.

Along the way, it garnered some impressive names on its shareholder register, including the UK advertising giant WPP.

Rupert Murdoch's 21st Century Fox acquired a 5% stake in the company for $70m as long ago as August 2013, while another shareholder was Raine, the merchant bank currently advising the Glazer family on its sale of Manchester United.

The most eye-catching investments, though, were made by Disney, which put in around $400m, most of it in 2015 and 2016. It eventually emerged with a 26% stake in the business whose value it wrote down to zero in 2019.

All were attracted by a business whose gonzo-style video journalism from trouble spots such as North Korea convinced many people that it had found a way to attract the sought-after young audiences that established media brands could not.

Vice had a peak market value of $5.7bn.

Vice had a peak market value of $5.7bn.

Mr Murdoch himself tweeted in October 2012 that Vice was "a wild, interesting effort to interest millennials who don't watch or read established media".

Unfortunately, it was that very empathy with millennial audiences that proved to be one of the factors behind the downfall of Vice.

The most obvious factor that hurt all of these businesses was a shift in the market that saw the lion's share of digital advertising revenues vacuumed up by the likes of Google and Facebook.

But another was that what appealed to millennials did not appeal to the subsequent Gen Z audience.

They opted instead for alternative platforms like TikTok and Snap. It is thought that Gen Z audience, rather more clean-living - some would say puritanical - than the Millennials, were repelled by aspects of Vice.

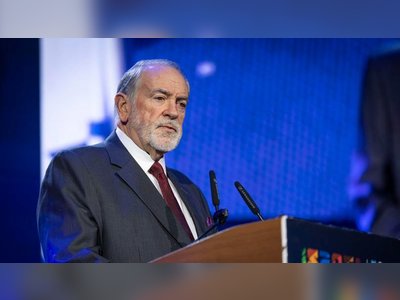

Rupert Murdoch was among investors at Vice.

Rupert Murdoch was among investors at Vice.

The group's 'bro' culture was very much driven by the personality of its co-founders. These included British-born Gavin McInnes, who later went on to achieve notoriety as a founder of the Proud Boys, the far-right organisation implicated in the storming of the US Capitol on 6 January 2021.

He, though, left in 2008.

In more recent times, the culture was set by another co-founder, Vice's former chief executive Shane Smith, who famously quibbled with a report in 2016 that he had spent $300,000 on a single dinner in Las Vegas, telling the Wall Street Journal: "It was $380,000, plus tip. I broke the Vegas tip record."

Almost inevitably, that 'bro' culture turned out to be indicative of something much worse, with the New York Times reporting on accusations of sexual misconduct in the company at the end of 2017. Two of its executives were suspended as a result and subsequently left the company.

By the beginning of 2018, investors were becoming frustrated at Vice's inability to make a profit from its large online audiences, while Mr Smith stepped down as chief executive in favour of Nancy Dubuc, a former broadcasting executive, who took steps to try and clean up the workplace culture.

The company became locked into a spiral of staff redundancies, followed by more declines in audience, followed by more redundancies. Costs were cut aggressively - even the Old Blue Last was sold - but profits remained stubbornly unattainable and particularly after the constraints of operating during the pandemic took a toll.

Ms Dubuc left in February this year, by which time, Vice was already being hawked to prospective buyers.

Vice is not the only digital media start-up to lurch from a crazy valuation to almost nothing.

Buzzfeed is another big name to have lost ground, closing its news operation

Buzzfeed is another big name to have lost ground, closing its news operation

Buzzfeed, which earlier this month closed its news operations and laid off 15% of its staff, has also suffered a big drop in its valuation as it soldiers on.

Vox Media, another scrappy new media start-up, has also laid off staff and in February this year fell into the arms of Penske Media Corporation, owner of established media titles such as Variety and Rolling Stone.

Business Insider and Politico, two more digital news start-ups that successfully built strong reputations, have been bought by another established media player in Axel Springer, owner of Bild and Die Welt, two of Germany's best-selling newspapers.

In the meantime, some older media titles are flourishing, thanks partly because their revenues are driven by subscriptions as well as advertising.

In the US, the New York Times has even bought a media start-up of its own in the shape of The Athletic, a sports-focused publication.

The Boston Globe has begun trading profitably since being bought by John Henry, the owner of Liverpool FC, thanks to some buoyant digital subscription revenues. And in the UK, The Times is making a sustained profit for the first time since it was bought by Mr Murdoch in 1981, again driven by strong digital subscriptions and award-winning journalism.

All of which shows the value of providing scintillating content that paying subscribers want to read and, perhaps, of having plenty of so-called 'brand equity'.

Yet the success of those titles - other examples include the Financial Times and the Wall Street Journal - has been hard-earned and is not being replicated everywhere.

The Washington Post, which has been owned by Amazon's founder Jeff Bezos for a decade, has been laying off staff and is widely reported to be up for sale after suffering falls in both circulation and subscription revenues.

The LA Times, owned for four years by the biotech billionaire Patrick Soon-Shiong, has lagged its rivals in terms of building subscriptions.

As for Vice, about to fall into the ownership of its creditors, it can at least point to having exerted an enormous amount of influence over the wider media industry.

It forced everyone from the BBC down to re-think their approach towards packaging journalism for a younger audience.

It also, however, provided a text-book example in how not to grow old with your readers, viewers and listeners.