Implications of Interest Rate Cuts on the Saudi Banking Sector: Will Banks Abandon Stimulating Savings Culture and Diversify Savings Products?

As the world anticipates the start of interest rate cuts during the current year 2024, after the US Federal Reserve maintained the rates unchanged in its last meeting in December, investors are increasingly betting that the central bank may have reached the end of this interest rate hike cycle. Predictions suggest that the Federal Reserve may cut interest rates by an average of 75 basis points in 2024. While initially expected to begin by the end of the first quarter, recent geopolitical events in the Red Sea that disrupted maritime navigation and increased shipping costs might postpone rate cuts until beyond mid-year.

In response to these predictions, Saudi banks have seen significant price increases, leading the Saudi stock market index to surpass 12,000 points. Banks had actually started to lower the returns on time and savings deposits to 5% from December onwards.

This report attempts to assess the impact of lowering interest rates on Saudi banks based on an analysis of customer deposits and loan distribution in financing portfolios, using attached charts that illustrate the extent to which each bank is affected by the interest rate reduction.

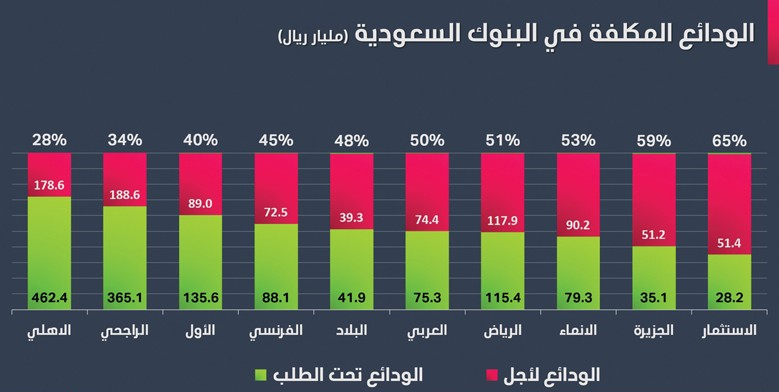

Initially, the effect of time and savings deposits on profit margins during the first nine months of 2023 is noted, whereby Saudi banks paid over 58 billion Saudi riyals in returns on deposits. Al Ahli Bank paid about 15 billion riyals, although costly deposits did not exceed 28% of its total, while the rest of the deposits were free of charge. Al Rajhi Bank paid nearly 12 billion riyals in returns on term deposits, which constituted 34% of its deposit volume, making it the bank with the largest costly deposits at approximately 188 billion riyals. Despite this, it seems to pay less in returns than other banks, which caused their value to decline from 202 billion riyals at the end of December 2022.

The Investment Bank has one of the highest costly deposit ratios at 65%, followed by Bank Al Jazira with about 59%, then Alinma Bank with approximately 53%. Some banks actively benefitted from the hike in deposit interest rates, attracting deposits from other banks and offering customers higher returns than the market average; however, they did not gain as much from attracting these deposits, reflected in their results. For instance, Bank Al Jazira's profits fell about 14% in the nine months of 2023, despite a 17% growth in its lending portfolio. The bank announced last week a 25% increase in its capital by capitalizing part of its statutory reserve, strengthening its capital base to enable it to achieve its strategic goals, including expanding lending, which may lower its deposit costs and improve profit margins if it succeeds in growing its financing portfolio.

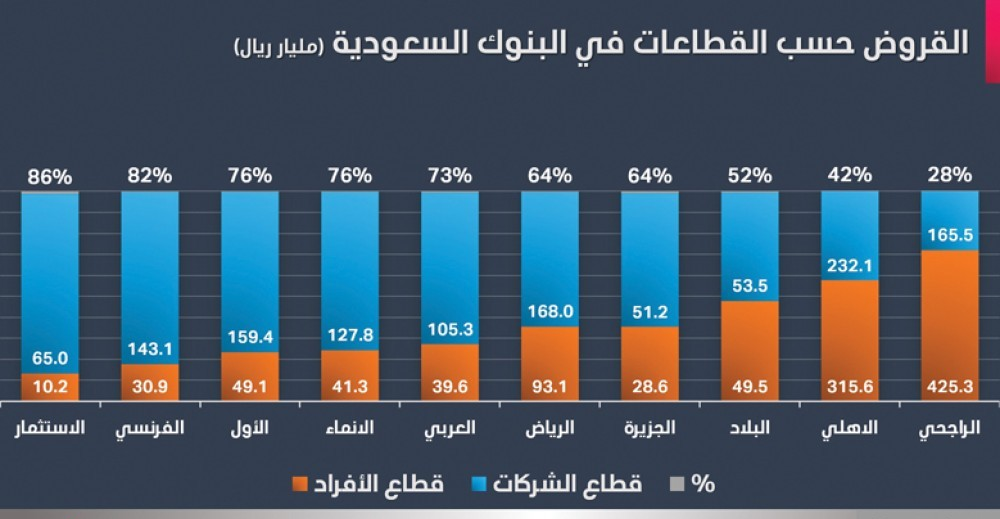

The combined net financing portfolio of Saudi banks exceeded 2.35 trillion riyals at the end of the third quarter, with 54% consisting of corporate loans, most of which are variable interest loans. Financial statements did not specify percentages for variable interest loans, except for the CEO of Riyad Bank who stated that 99.5% of the bank's corporate lending portfolio is characterized by variable interest rates, which change for customers according to the movements of the SAIBOR rate.

It can be stated that all banks will benefit from reduced interest rates on deposits, especially those with significant costly deposits. However, the benefit is greater for banks with large fixed-interest loans, particularly individual loans where the impact of high interest rates continues for at least the next three years, including Al Rajhi Bank and Al Ahli Bank. In contrast, banks with significant corporate exposure to variable interest rates will be negatively affected by interest rate cuts unless they manage to increase lending.

With rising interest rates, returns on savings products also increased, contributing to the growth of savings culture among individuals. The Saudi Central Bank also encouraged banks to increase the volume of savings account balances by giving them greater weight when calculating the loan-to-deposit ratio, leading to a race in diversifying savings products and marketing them to enable lending expansion. However, with the expected reduction in interest rates, banks may abandon offering decent returns that encourage customers to continue saving. While we do not demand that banks offer returns that could cause them losses, we call for returns that keep savings accounts sustainable and growing, putting them to use in investments that yield slightly higher returns.

This report attempts to assess the impact of lowering interest rates on Saudi banks based on an analysis of customer deposits and loan distribution in financing portfolios, using attached charts that illustrate the extent to which each bank is affected by the interest rate reduction.

Initially, the effect of time and savings deposits on profit margins during the first nine months of 2023 is noted, whereby Saudi banks paid over 58 billion Saudi riyals in returns on deposits. Al Ahli Bank paid about 15 billion riyals, although costly deposits did not exceed 28% of its total, while the rest of the deposits were free of charge. Al Rajhi Bank paid nearly 12 billion riyals in returns on term deposits, which constituted 34% of its deposit volume, making it the bank with the largest costly deposits at approximately 188 billion riyals. Despite this, it seems to pay less in returns than other banks, which caused their value to decline from 202 billion riyals at the end of December 2022.

The Investment Bank has one of the highest costly deposit ratios at 65%, followed by Bank Al Jazira with about 59%, then Alinma Bank with approximately 53%. Some banks actively benefitted from the hike in deposit interest rates, attracting deposits from other banks and offering customers higher returns than the market average; however, they did not gain as much from attracting these deposits, reflected in their results. For instance, Bank Al Jazira's profits fell about 14% in the nine months of 2023, despite a 17% growth in its lending portfolio. The bank announced last week a 25% increase in its capital by capitalizing part of its statutory reserve, strengthening its capital base to enable it to achieve its strategic goals, including expanding lending, which may lower its deposit costs and improve profit margins if it succeeds in growing its financing portfolio.

The combined net financing portfolio of Saudi banks exceeded 2.35 trillion riyals at the end of the third quarter, with 54% consisting of corporate loans, most of which are variable interest loans. Financial statements did not specify percentages for variable interest loans, except for the CEO of Riyad Bank who stated that 99.5% of the bank's corporate lending portfolio is characterized by variable interest rates, which change for customers according to the movements of the SAIBOR rate.

It can be stated that all banks will benefit from reduced interest rates on deposits, especially those with significant costly deposits. However, the benefit is greater for banks with large fixed-interest loans, particularly individual loans where the impact of high interest rates continues for at least the next three years, including Al Rajhi Bank and Al Ahli Bank. In contrast, banks with significant corporate exposure to variable interest rates will be negatively affected by interest rate cuts unless they manage to increase lending.

With rising interest rates, returns on savings products also increased, contributing to the growth of savings culture among individuals. The Saudi Central Bank also encouraged banks to increase the volume of savings account balances by giving them greater weight when calculating the loan-to-deposit ratio, leading to a race in diversifying savings products and marketing them to enable lending expansion. However, with the expected reduction in interest rates, banks may abandon offering decent returns that encourage customers to continue saving. While we do not demand that banks offer returns that could cause them losses, we call for returns that keep savings accounts sustainable and growing, putting them to use in investments that yield slightly higher returns.