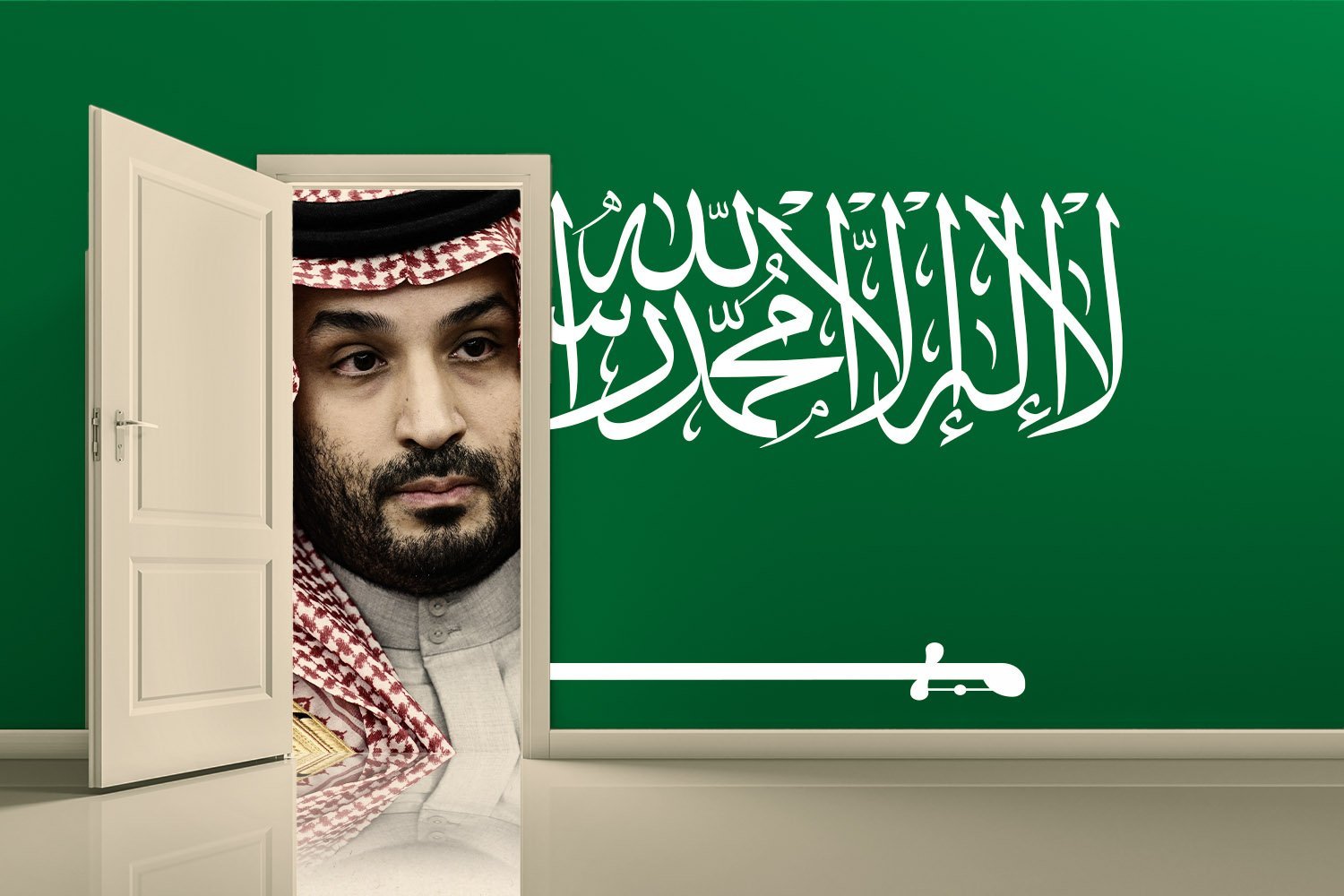

Saudi Arabia to Open Real Estate Market to Foreign Buyers in January 2026

Non-Saudis will be allowed to purchase residential, commercial, industrial and agricultural land in designated zones under new ownership law

Saudi Arabia is preparing to allow foreign individuals and companies to acquire real-estate assets from January 2026, under the newly approved ‘Law of Real Estate Ownership by Non-Saudis’, the Real Estate General Authority (REGA) confirmed in recent statements.

The reform will permit non-Saudi buyers to obtain ownership or other real rights over residential, commercial, industrial and agricultural property, within geographic zones to be defined by the Saudi government.

Under the law, the zone map will include major cities such as Riyadh and Jeddah, and will also address the holy cities of Mecca and Madinah — where ownership by non-Saudis will remain restricted or conditional, for example limited to Muslim buyers or structured through endowments.

The legislation marks a pivot in the Kingdom’s efforts to attract foreign direct investment, boost its non-oil economy and align with its Vision 2030 reform agenda.

The law replaces previous legislation dating back more than two decades and introduces transparent procedures, registration requirements, ownership-percentage limits within zones and a fee regime — including a transfer fee of up to five percent for foreign buyers.

REGA clarified that ownership rights held by non-Saudis will only be valid after registration in the national real-estate registry, and that detailed regulations and technical maps of the designated zones will be published shortly.

Early commentary from the authority indicates that foreign ownership quotas in these zones may range between seventy and ninety percent of a given development, depending on location.

While the law will take effect in January, implementation will be phased: REGA will issue the geographic scope, types of permitted rights and other controls within 180 days of the law’s publication, allowing market participants to prepare.

Observers say that this change is among the most significant liberalisations of Saudi Arabia’s property market to date and will open the Kingdom to a broader range of global investors and expatriates looking to access real-estate ownership for residence, investment or corporate purposes.

The reform will permit non-Saudi buyers to obtain ownership or other real rights over residential, commercial, industrial and agricultural property, within geographic zones to be defined by the Saudi government.

Under the law, the zone map will include major cities such as Riyadh and Jeddah, and will also address the holy cities of Mecca and Madinah — where ownership by non-Saudis will remain restricted or conditional, for example limited to Muslim buyers or structured through endowments.

The legislation marks a pivot in the Kingdom’s efforts to attract foreign direct investment, boost its non-oil economy and align with its Vision 2030 reform agenda.

The law replaces previous legislation dating back more than two decades and introduces transparent procedures, registration requirements, ownership-percentage limits within zones and a fee regime — including a transfer fee of up to five percent for foreign buyers.

REGA clarified that ownership rights held by non-Saudis will only be valid after registration in the national real-estate registry, and that detailed regulations and technical maps of the designated zones will be published shortly.

Early commentary from the authority indicates that foreign ownership quotas in these zones may range between seventy and ninety percent of a given development, depending on location.

While the law will take effect in January, implementation will be phased: REGA will issue the geographic scope, types of permitted rights and other controls within 180 days of the law’s publication, allowing market participants to prepare.

Observers say that this change is among the most significant liberalisations of Saudi Arabia’s property market to date and will open the Kingdom to a broader range of global investors and expatriates looking to access real-estate ownership for residence, investment or corporate purposes.